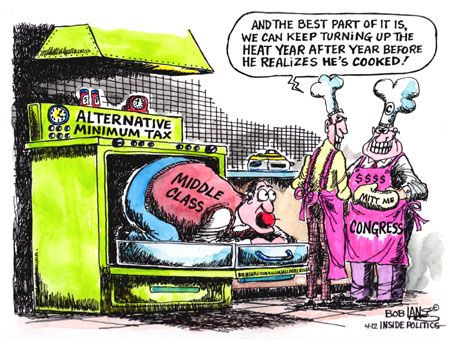

Filing Season Opens on Time Except for Certain Taxpayers Potentially Affected by AMT Patch

IR-2007-209, Dec. 27, 2007

WASHINGTON — The Internal Revenue Service announced today that the upcoming tax season is expected to start on time for everyone except certain taxpayers potentially affected by late enactment of the Alternative Minimum Tax “patch.”

Following extensive work in recent weeks, the IRS expects to be able to begin processing returns for the vast majority of taxpayers in mid-January. However, as many as 13.5 million taxpayers using five forms related to the Alternative Minimum Tax (AMT) legislation will have to wait to file tax returns until the IRS completes the reprogramming of its systems for the new law.

The IRS has targeted Feb. 11, as the potential starting date for taxpayers to begin submitting the five AMT-related returns affected by the legislation. The February date allows the IRS enough time to update and test its systems to accommodate the AMT changes without major disruptions to other operations related to the tax season. As the IRS has said previously, it will take approximately seven weeks after the AMT patch was approved to update IRS processing systems completely.

Although as many as 13.5 million taxpayers will not be able to file their returns until Feb. 11, the effect of the delay may be lessened by the fact that under previous filing patterns only between 3 million to 4 million taxpayers file returns with the five affected forms during these early weeks in the filing season.

“We regret the inconvenience the delay will mean for millions of early tax filers, especially those expecting a refund,” said Linda Stiff, Acting IRS Commissioner. “We’ve taken extraordinary steps to figure out a way that we can start the filing season on time for most taxpayers, including some using AMT-related forms. Our goal has always been to make sure we can accurately process tax returns while getting refunds to taxpayers as quickly as possible.”

The February delay caused by the AMT patch will affect taxpayers using any of these five forms:

*

Form 8863, Education Credits.

*

Form 5695, Residential Energy Credits.

*

Form 1040A’s Schedule 2, Child and Dependent Care Expenses for Form 1040A Filers.

*

Form 8396, Mortgage Interest Credit.

*

Form 8859, District of Columbia First-Time Homebuyer Credit.

While these five forms require significant additional reprogramming due to the AMT patch, the IRS has been able to reprogram its systems to begin processing seven other AMT-related forms, including Form 6251, Alternative Minimum Tax – Individuals. Taxpayers filing these seven forms should not experience delays in filing, and the IRS expects to begin processing those returns starting on Jan. 14.

Electronic returns involving those five forms will not be accepted until systems are updated in February; similarly, paper filers should wait to file as well. All other e-file and paper returns will be accepted starting in January. The IRS urges affected taxpayers to file electronically in order to reduce wait times for their refunds. E-file with direct deposit gets refunds in as little as 10 days, while paper returns take four to six weeks.

“E-file is a great option for everyone, especially if they are affected by the AMT,” said Richard Spires, IRS Deputy Commissioner for Operations Support. “Filing electronically will get people their refunds faster, and e-file greatly reduces the chances for making an error on the AMT or other tax issues.”

In addition to filing electronically, the IRS urges taxpayers to take simple steps to avoid problems:

*

Taxpayers filing electronically should make sure to update their tax software in order to get the latest AMT updates.

*

Taxpayers with $54,000 or less in Adjusted Gross Income can use Free File to electronically file their returns for free. Free File will only be available by visiting the official IRS web site at IRS.gov. In all, 90 million taxpayers qualify for this free service.

*

Taxpayers who use tax software to print out paper copies of tax forms should make sure they update their software before printing out forms. Taxpayers using paper forms can also visit IRS.gov to get updated copies of AMT forms.

The IRS has created a special section on IRS.gov to provide taxpayers with additional information and copies of updated forms affected by the AMT. In recent days, the IRS has posted updated copies of all forms affected by the late enactment of the AMT patch by Congress.

The IRS also reminds taxpayers that printed tax packages, which will begin arriving in the mail around New Year’s, went to the printer in November before the AMT changes were enacted. The packages reflect the law in effect at the time of printing. The tax packages include cautionary language to taxpayers that late legislation was pending.

The IRS is also working closely with tax professionals and the tax preparation software community to make sure they can help taxpayers with all of the latest developments on the enactment of the AMT patch and other tax changes.

“The IRS is going to continue to do everything it can to make this a fully successful filing season for the nation’s taxpayers,” Stiff said. “We will continue to work to keep taxpayers up to date and make this situation as easy as possible for everyone.”